Today, the industry seems to be enamored of the idea of using “influencers” to sell their product. I’m not a fan, but neither am I against the idea of “tribes” or “followers” or whatever you want to call them. It’s just that “tribes” that don’t “buy” are really nothing more than shoppers. If your brand’s going to be successful, you need to “purchasers” to become advocates for your brand. If you can’t monetize the zillion people following the “celebrity influencer du jour” you need to reexamine the priorities.

Here’s my biggest concern: if someone’s representing your brand and they’re not recognized experts or authorities (think Jerry Miculek/S&W revolvers, Rob Leatham/Springfield Armory’s 1911s, Daniel Horner, Max Michel and Lena Miulek with SIGs, or Doug Koenig with Rugers), you might want to rethink your strategy.

And even then, you need some pretty solid rules to guide the relationships.

Even with those, there are no guarantees something bad won’t happen.

You need to realize you’re essentially trusting your brand to someone who might one day go “off the reservation.” And anything they say or post in today’s instant outrage culture can have far-reaching implications -for them and your brand.

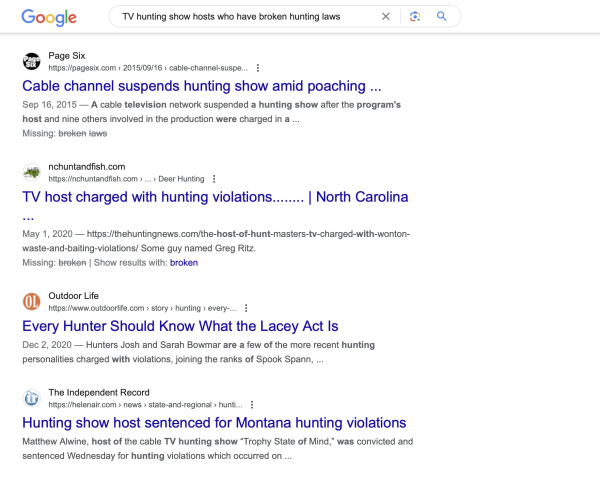

God forbid they do something illegal. That is catastrophic. If you think I’m exaggerating, Google “TV hunting hosts who have broken hunting laws.” I stopped reading at the tenth page -but I was reminded of all the violators whose names have essentially been erased by former sponsors.

The industry has plenty of formerly well-known “TV celebrity hunters” who are outcasts today. They were decidedly effective at using their endorsed products, but “used by a convicted Lacey violator” has considerably less panache than “chosen by discriminating hunters.”

Not every regulation was knowingly broken, neither did every guilty verdict mean the death penalty for the TV show or its host.

But every brand associated with the show and the host was impacted.

Please remember there are two types of “reach” and “impact.” Only one’s good for business.

On a completely different topic- it looks like everyone watching the Vista/CSG/MNC soap opera, er, sale needs to press the pause button-again.

Yesterday, the offer price from Czechoslovak Group (CSG) went up to $2.15 billion - a fifty million dollar jump in their purchase offer.

All this follows Friday’s news that Vista Outdoors’ second largest shareholder, Gates Capital Management, announced they were opposing the proposed sale of Vista’s The Kinetic Group to Czechoslovak Group (CSG). They appear to want more time to see if the MNC Capital offer isn’t better- or won’t be sweetened.

That hasn’t changed opinions at VISTA. A statement from Vista’s Chairman of the Board Michael Callahan says, “We are confident the transaction with CSG maximizes value for our shareholders and provides stockholders the opportunity to realize significant value in Revelyst when separated from The Kinetic Group.

Callahan sounds confident, but the shareholder meeting originally set for today has been postponed until July 30.

Fox News reported Friday that despite the opposition by shareholders, spurned suitor MNC Capital insists their last and final proposal is on the table ($3.2 billion) for Vista.

Company officials have said-repeatedly- that it feels the deal “significantly undervalues Vista Outdoor as a whole and especially the Revelyst business.”

That offer, would also be subject to due diligence.

Meanwhile, CSG says it is ready, willing -and approved by the Committee on Foreign Investment (CIFUS) - for the sale. The Prague, Czechoslovakia based company had originally felt that approval would be the major stumbling block in the acquisition.

Seems MNC is determined to change that opinion.

If shareholders approve the CSG deal next week, Callahan says the CSG/Vista transaction has the “ability to close in early August.” As you might expect, Vista shares were up in trading yesterday. Shareholders of record at the sale’s conclusion -in the CSG deal- would get the purchase price per share, a portion of an additional $125 million in cash from Vista and a share in Revelyst for each Vista share.

As always, we’ll keep you posted.

— Jim Shepherd